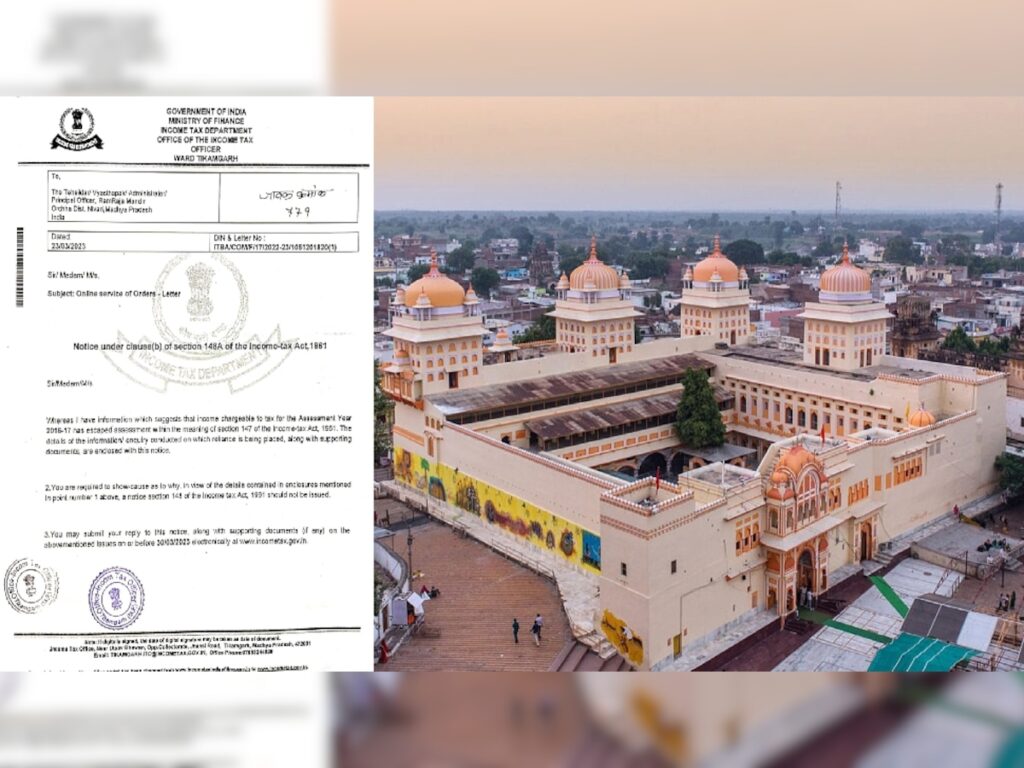

Madhya Pradesh: Income tax notice to Lord Rama, 1.22 crores sought from Ramraja temple of Orchha

In Orchha, the Income Tax Department has come under fire for the FD of 1 crore 22 lakh 55 thousand belonging to the Shri Ramraja government treasury. The matter is going on since 2016. The Income Tax Department issues notices again and again and the Tehsildar and the temple administrator tell the temple to be under government control. Despite this, the Income Tax Department issues notices. Recently, notice was also received in last March.

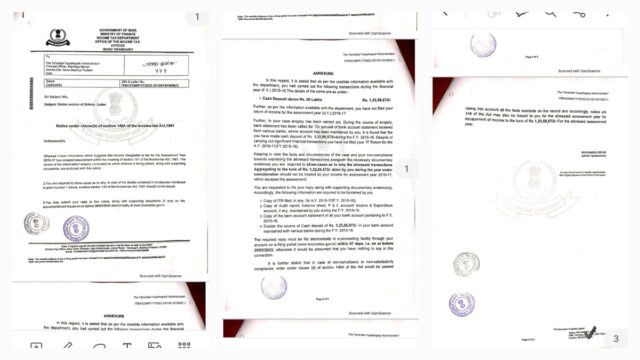

The Income Tax Department has issued a notice to the Tehsildar, Administrator, Manager, Chief Officer of the world famous Shri Ramraja Sarkar Temple in Orchha from the Tikamgarh office, stating the source of income of the FD of Rs 1 crore 22 lakh 55 thousand 572 made in the bank and its one-time income tax Notice of submission has been issued.

However, the Orchha Tehsildar, as the administrator of the temple committee, while replying to the notice to the Income Tax in this matter, has told the temple trust to be government owned and exempt from income tax. Despite this, the Income Tax officials are not satisfied with this, due to which the officials have presented the documents in front of the Income Tax Officer after meeting them personally.

It’s all about

According to the information received from the temple administration and the Tehsildar office, the Income Tax Department has issued a notice to the Orchha Ramraja Sarkar temple administration on March 23, 2023, asking them to deposit income tax citing the rules for depositing more than 50 lakh cash. In this, in the year 2016-17, the FD was made by the temple committee by depositing cash in the bank. The Income Tax Department is demanding an account of the same from where this amount has come to the temple committee. In response to the notice, Tehsildar Manish Jain, as the administrator of the temple committee, has responded by submitting information and documents that the temple is under government ownership and exempted from income tax. Tell that after the year 2010, in the year 2016 and now in March 2023, the Income Tax Department has issued a notice to the temple asking for information about all the bank accounts of the temple including balance seat, audit report, P&L account, income-expenditure details. According to Tehsildar Manish Jain, in the year 2015-16, the temple management had withdrawn money from a bank and deposited it in SBI account and got FD done, after that the department is giving notice.