RBI’s employment data is increasing, the number of clerks in banks has been reduced by half, recruitment started cutting

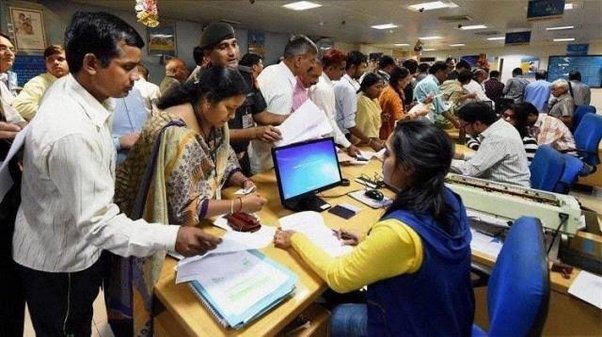

The number of clerks in banks is continuously decreasing. Banks have gradually cut down on clerk recruitment due to the use of technology to send files digitally and people prefer online transactions instead of visiting branches. The share of clerical jobs in India’s banking system was more than 50% in the early 90s, which has now come down to 22 percent. This has been revealed from the bank employment data released by the Reserve Bank of India.

Reduced role due to technology

The job of a bank clerk is mainly that of document preparation, assistant to officers, teller, cashier etc. According to experts, with the rapid advancement of technology, the dependence on clerks in banks has reduced. Long queues at bank branches in urban areas have reduced due to the advent of mobile phones and cheaper data plans.

What do experts say?

Vinu Nehru Dutta, Managing Partner, FineHand Consultants said that technology has played a major role in reducing bank clerks. I feel that due to automation, the role of clerks for the operation of banks is no longer as central as before.

Today one does not need to transfer too many files or do a lot of paperwork. Aditya Narayan Mishra, CEO, CL HR Services said that digitization has made many jobs, including clerks, redundant. There have also been many changes in the focus areas of banks, which have affected these jobs.

Union is protesting

At the same time, bank unions are opposing the sidelining of clerks. CH Venkatachalam, general secretary of the All India Bank Employees Association, said that the less money is spent on the appointment of clerks, they are a useful resource. When banks can hire more clerks at a salary starting from Rs 30,000, why should officers hire at a salary of Rs 70,000?