Do you know why banks take Cancelled/Cancel Cheque? no, then you know

If you have invested in any insurance company, bank or any other financial institution or have applied for loan etc., then you may also have been asked for canceled check of your bank account. And you have given canceled check without asking any question. Have you ever wondered what insurance companies, banks or other financial institutions do with your canceled cheque? Probably not. In today’s article, you are going to get the answer to this question.

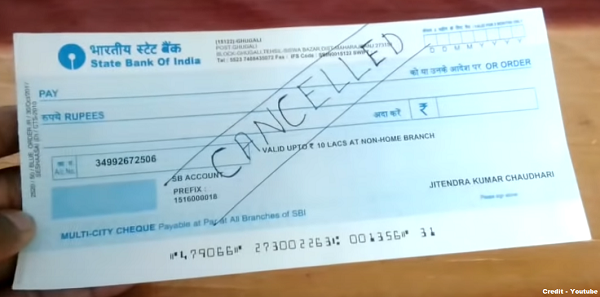

Signature is not necessary on Cancel Cheque

When you give a canceled check to someone, there is no need to sign the canceled check. You only have to write cancel on this. Apart from this, a cross mark can be made on the cheque. This type of check only verifies your account. If you have given a canceled bank check to an institution, it means that you have an account with that bank. Your name may or may not be on the check. Your account number is written and the IFSC code of the branch where the account is located is written. Please tell that you should always use only black and blue ink for cancel cheque, no other color ink should be used. Otherwise your check will be dishonoured.

When is a canceled check required?

When you do any work related to finance, a canceled check is asked. Lenders ask for a canceled check when you take a car loan, personal loan, home loan. This is done only to verify your account. If withdrawing money from provident fund offline, then a canceled check is required. If you invest in mutual funds, companies ask for canceled check details. Apart from this, it is also needed when buying an insurance policy.